The changes in the retail trade and their impact on the city of Zurich

"City of Future Trade in Transition" a project of urban development Zurich

.

September 7, 2017 Anna Schindler

In December 2016, Amazon opened its first grocery store without cash registers in Seattle. An app on the smartphone uses sensors to digitally record everything the buyer takes off the shelf and place it in a virtual shopping basket. When leaving the store, the invoice is automatically debited from the customer's Amazon account.

Checkout-free shopping still seems to suffer from some teething troubles – but will it determine the future shopping habits of customers and thus the structure and offer of retail in the cities? Or will it be online offers such as the clothing supplier Zalando, the electronics portal "digitec" or the virtual bookseller Amazon that question today's significance, today's store concepts and today's spatial structure of brick-and-mortar retail? Online providers are changing the world of retail – especially logistics. Couriers, express services and parcel deliveries are constantly increasing – small units have to be delivered quickly and bring more and more traffic to the cities, but the transport business in relation to the effort has little revenue.

In the future, experts agree, digital retail will play a central role. The focus is likely to be on so-called multi- and cross-channel offers, i.e. forms of sales in which customer contact offline and online takes place in parallel and combined, where stationary shops serve as bases for direct contact with customers, in which you can also pay, order and attach your delivery wishes via the Internet at the same time. Logistics is also likely to change fundamentally, thanks to drones for lightweight and urgent deliveries and self-driving electric delivery vans on the district streets that distribute goods from a central collection point to the individual houses – the visions of the future are versatile and perhaps they will become reality faster than expected.

Because the structural change in the retail trade is rapid, new players are pressuring the established companies: In the early summer of 2017, Amazon bought the American retail group Whole Foods, and Amazon shares jumped over the $ 1000 mark. Online is paired with offline: In Switzerland, too, e-commerce sales have risen by almost 70 percent since 2008 to just under eight billion Swiss francs. The largest increase was recorded in the clothing industry.

The change in the retail trade is by no means the same everywhere. In Japan, for example, neighbourhood shops are not dying out as they are in many places in Europe, but are experiencing a new upswing, as is the case with the Lawson retail chain – here too thanks to the digitization of shopping, as pilot tests illustrate. Human cashiers are replaced by "cash register robots" that automatically scan the goods, pack them in a bag and at the same time report the sales to a digital warehousing system. Payment is made in cash or by card, all without the shopper coming into contact with a person. Thanks to these innovations, the number of these micro-shops, called "Kombinis", is said to have risen by 2.7 percent in 2016 to a new record of over 54,000 shops, the NZZ wrote on Sunday at the end of May. "Kombinis" not only offer a wide range of products from fast food to underwear, but also banking services, sell cinema tickets online or allow customers to pay taxes or electricity bills at the ticket office. On the logistics side, these new "mom-and-pop shops" pose enormous challenges.

We are not yet ready in Switzerland. The retail trade in Germany is suffering – from the strong franc, the online boom, high costs and shopping tourism. According to Credit Suisse, at the end of 2016, around 100,000 m2 of retail space is vacant nationwide, and according to Wüest & Partner's calculations, more than 500,000 m2 are currently under construction, most of them in small and medium-sized centers, but also in the core cities and agglomerations. According to estimates by the Reida association, the median rent for new retail space to be allocated in Switzerland in 2016 was CHF 320/m2, around 6% lower than in the previous year.

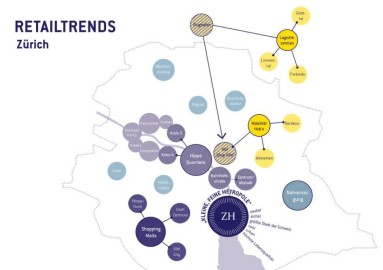

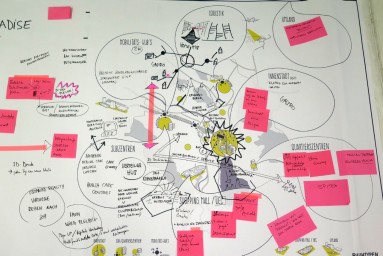

Innovative concepts are in demand. The first edition of the "City of the Future" project of Zurich's urban development in 2017 was dedicated to the search for such projects. It tried to understand where the journey of the retail trade – which is a strong city-defining force – could go and what impacts and challenges this would result for the city. The topic of retail in urban areas is becoming increasingly important in Zurich – both for the public sector and for society and the economy. Consumption and local supply are among the core elements of a vibrant and prosperous city. That is why the city of Zurich must devote increasing urgency to future consumer, retail and post-supply developments and define the right economic, social and spatial options for action. Zurich's urban development has been dealing with this topic for a long time – with centre structures in the city of Zurich or with local supply in the districts – and is observing the development of the public-oriented industry.

The question of the "change in trade" and its effects on the spatial and social structure of the city of Zurich concerns all three central city functions: the quality of the supplementary care for living, the situation of the trade when working and the use of space as a meeting place for social interaction. The challenges are manifold and manifest themselves at different levels of urban life and everyday life – and they force innovation. Multi-channel sales, for example, offer opportunities for well-known and new retail concepts. The urban space is increasingly becoming the backdrop for experience-oriented shopping, while the extensive purchases outside are made in the supermarkets and specialist stores or satisfied online with home delivery. At the same time, however, the transformation of the retail trade driven by digitization also reveals opposing tendencies that emphasize the local and authentic. In combination with the importance of physical places where goods are purchased (pick-up points), confirmed by various experts, there could well be opportunities for a decentralised supply structure and for new small shops. In any case, accessibility within and outside the city is becoming increasingly important.

As a result, cities need strategies to deal with trends in the retail trade and in the care of their inhabitants. Neighbourhood centres are places of identification for urban society. What takes place there, in what quality and for what reason, is image- and identity-forming for a city – and local supply plays a central role in this.

In cooperation with internal and external experts, the "City of the Future" project of Stadtentwicklung Zürich designed scenarios for these topics and questions and sought possible answers in the form of recommendations for action for politics, the authorities and the stakeholders concerned. These were publicly presented and reflected on by well-known discussion partners from the industry and spatial development in December 2017.